Prescription drug coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard prescription drug coverage under Medicare Part D, as demonstrated through the use of generally accepted actuarial principles and in accordance with Centers for Medicare and Medicaid Services (CMS) actuarial guidelines. In general, the actuarial equivalence test measures whether the expected amount of paid claims under the employer's prescription drug coverage is at least as much as the expected amount of paid claims under the standard Part D benefit.

See the frequently asked questions for more information or visit the CMS Creditable Coverage website for more information about creditable coverage, including access to model disclosure communication templates published by CMS. Updates are made regularly, so please check the websites often for the most up-to-date information.

The Medicare Modernization Act (MMA) mandates that certain entities offering prescription drug coverage, including employer and union group health plan sponsors, disclose to all Medicare eligible individuals with prescription drug coverage under the plan whether such coverage is “creditable”. This information is essential to an individual's decision whether to enroll in a Medicare Part D prescription drug plan.

If an employer offers a prescription drug plan to Medicare eligible individuals, understand that:

NOTE: 2025 Creditable Coverage tools are available below.

Member notices. Employers must provide Notice of Creditable Coverage (NOCC) to all Medicare eligible individuals who are covered under, or who apply for, the entity's prescription drug plan (Part D eligible). This disclosure must be provided to Medicare eligible active working individuals and their dependents, Medicare eligible COBRA individuals and their dependents, Medicare eligible disabled individuals covered under the prescription drug plan and any retirees and their dependents at least once a year prior to October 15. This information is essential to an individual's decision to enroll in a Medicare Part D prescription drug plan. CMS publishes model disclosure communication templates that can be accessed here.

CMS disclosure. In addition, employers are required to provide CMS with their plan's creditable or non-creditable coverage status annually via an online form, found here.

Retiree drug subsidy. If the employer coverage is creditable, plan sponsors may be eligible to pursue a subsidy through the Retiree Drug Subsidy (RDS) Program. This optional step requires additional testing and an application process. They can apply for the subsidy by going to: www.rds.cms.hhs.gov.

They must apply for the subsidy 90 days prior to the beginning of an RDS plan year, which can mirror a benefit plan year. For example, if their benefit plan year begins January 1, and the client wants their RDS plan year to be the same, they would apply for the subsidy by October 1. If they request an extension, CMS will grant an additional 30 days to complete the application.

Simplified determination. CMS has clarified that if an employer is not applying for the subsidy, the employer can determine that its prescription drug plan's coverage is creditable if the plan design meets all four of the following criteria:

Plans that meet these four criteria are deemed to be creditable.

Calendar year plans should be tested against the 2025 Medicare Part D parameters. If the plan design subsequently changes prior to 1/1/2025, the plan should be re-tested to determine if there is a change in creditable coverage status. Any change in creditable coverage status should be disclosed to members.

Off-calendar year (2024-2025) plans should be tested against the 2024 Medicare Part D parameters. If the plan design subsequently changes for the 2025-2026 renewal/coverage period, the plan should be retested against the 2025 Medicare Part D parameters to determine if there is a change in creditable coverage status. Any change in creditable coverage status should be disclosed to members.

Small Business is defined as group size 1-50 in all states except CA, CO, NY where small group is also defined as group size 1-100.

If your plan is not a small group plan, please use these results to determine if your plan is creditable.

In a screen sharing video, the UnitedHealthcare website is open to a page for Medicare Part D Creditable Coverage.

MALE NARRATOR: Welcome everyone. So this is the training for the UHC Creditable Coverage Plan lookup tool. So here we’re on the UHC Creditable Coverage site, which explains a lot about Creditable Coverage, and if you scroll down to the bottom, you’ll be able to find the tool.

He right-clicks on UHC 2021 Plan Lookup (xlsm) and selects Save link as…

MALE NARRATOR: So we’re using the plan lookup tool. So we’re going to save that to our desktop or our local disk because it runs faster there than on network drives. It might take a little bit to download because it’s a big file. Then once it’s downloaded, we’re going to open it.

The tool opens in Microsoft Excel. A banner at the top reads SECURITY WARNING Macros have been disabled. He clicks Enable Content.

MALE NARRATOR: So once it opens, you should see a banner up top that says “Macros have been disabled. Enable Content.” You want to make sure that it is enabled.

A popup window states “Please enable macros prior to entering information. Not doing so will result in Input Validation Errors. You can enable macros by clicking on ENABLE CONTENT button (highlighted in yellow) at the top of this page. If you do not see this option, macros should already be enabled.” He clicks OK.

MALE NARRATOR: So you want to click that, or you might get this little popup, which means macros are enabled, but you just want to make sure that macros are enabled or else the tool isn’t going to run properly. So we’ll click that and then we’ll move on. So there’s three tabs in the workbook. We have the Batch tab, and we’ll just look at the Instructions.

He clicks into the Instructions tab.

MALE NARRATOR: The Instructions tab just says all the inputs you need for it to run properly and then what the different results mean.

He clicks into the FAQ tab.

MALE NARRATOR: Then there’s also an FAQ because at the Creditable Coverage mailbox you know lots of questions come in, so these are just the most common questions we get and some quick answers.

He clicks into the Batch tab.

MALE NARRATOR: Now if we go back Batch tab, this is the main interface for getting the Creditable Coverage determinations. So we have the four steps here. Choose number of plans. Select PDF. Enter the designs and display. So the main change here in this tool is that you can test multiple plans from one to fifty at a time. So you can just input the number of plans there. So we’re going to do four examples, so we’ll put four and it’ll adjust accordingly.

He changes the number of plans from two to four, and two more columns appear on the spreadsheet.

MALE NARRATOR: And then if you want a PDF output of the plan design with the result, then you can choose the location. So you click the Browse button and you would choose the folder there.

He selects a temp folder in documents.

MALE NARRATOR: And it’ll make another folder within there that will have the PDF of the result that you choose. So now we move onto the inputs, so for the first plan you start with information, so you add a group name. You add the plan description. This is the 2021 version, so the effective date has to be within 2021. The we move on—If you want a PDF of the result, this is just a yes/no. So we do, so we’re gonna say yes. And then you go onto the plan designs, so how many RX tiers? So 2, 3, 4, or 5 tiers. So we’re gonna choose 3. Next within this is the deductible applies to which tiers? So you can do all, or you can do two and above or three and above. Next we move onto the deductible itself, so you can No RX Deductible, RX Only, or Combined with Medical. So in this example we have No RX Deductible, so it’s going to gray out the other selections in that field. We move onto the out-of-pocket max. So this has very similar selections. So "no out-of-pocket max," "Rx only," or "combined with medical." So we're gonna choose "combine with medical." Next, you can choose between embedded or non-embedded or N/A, which is pretty rare. And then you can choose--input the individual and family amounts for the out-of-pocket max. Next, we move on to the prescription drug cost sharing. So if it's just a straight copay, then you would input the whole number. If it's a coinsurance, then you would input it as a decimal. So you don't need to put the percentage sign or dollar sign; it'll do it automatically, depending on how you input it. After that, we move on to the drug list. So you either don't know, or it's a standard drug list, or it's a core or expanded buy up. And you'll adjust accordingly, so we're choosing "no - standard." And then if the plan is an HRA. So again, that's gonna be a yes or no. If yes, you're gonna be prompted to input the employer contribution to the HRA. But for our purposes, we're gonna choose no.

He finishes filling out the columns.

MALE NARRATOR: Okay, so now we have our four examples loaded. So once you do that, you can click the Display Creditability Results button, and the program will run.

The results appear as new rows at the bottom.

MALE NARRATOR: So down at the bottom, you can see the results. So the first one passes, which means the plan is creditable for 2021. The next one fails, which means it's not creditable. The third is Custom Test Required, which means that you're going to have to send it to the creditable coverage mailbox, which we will talk about later, to get a result for that one. And the last one, you can see in the additional comments, "Check notes on orange cells. Validate inputs and run again." You can see it has validation errors; there are five. So if we were to scroll up there, then we can see the five cells that are orange and have the comments telling you that you need to input. So we need to input the individual and family deductible amounts, and then the tiers one through three cost sharing.

He fills in the missing information, then clicks Display Creditability Results.

MALE NARRATOR: So after that, we can run it again, and then we'll get a result for that one. And it will auto-generate the other ones again as well, but you can always just check that one to know if you don't

want it. So that one passes. So that means that is creditable for 2021. So then if we go to the directory that we named as the PDF output location, we can see the folder that has the results. So we're gonna look at two of these.

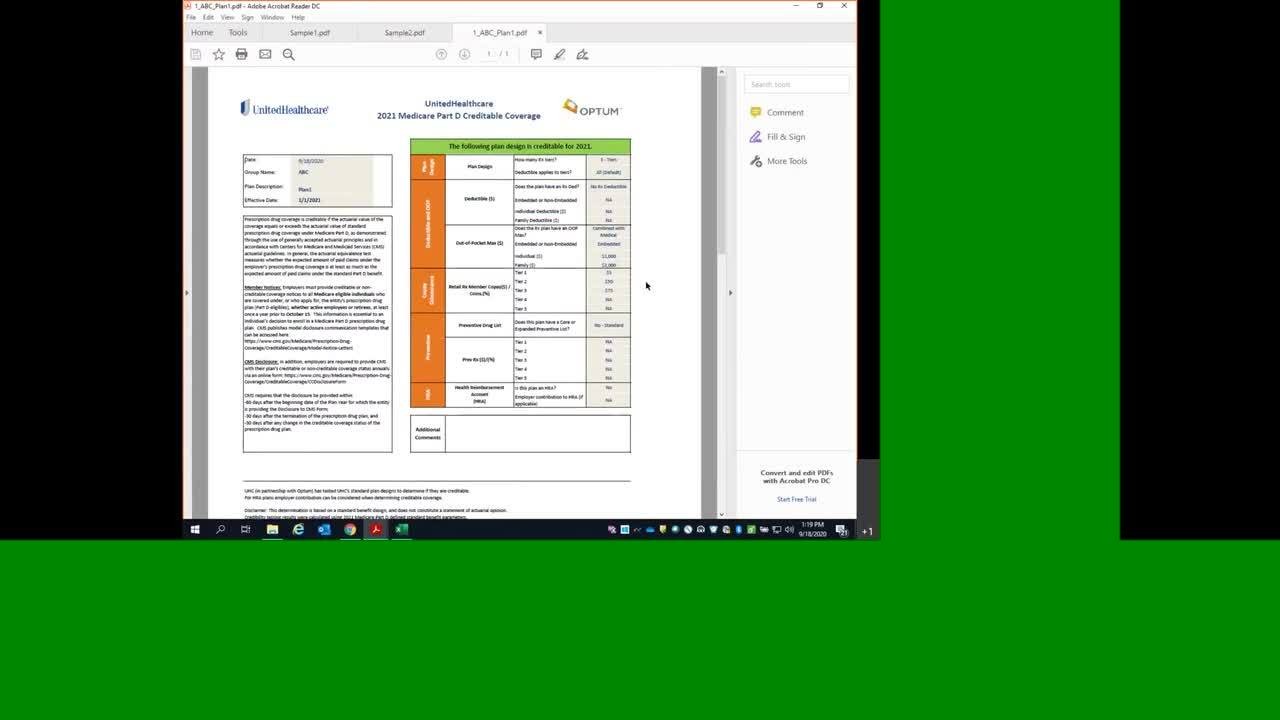

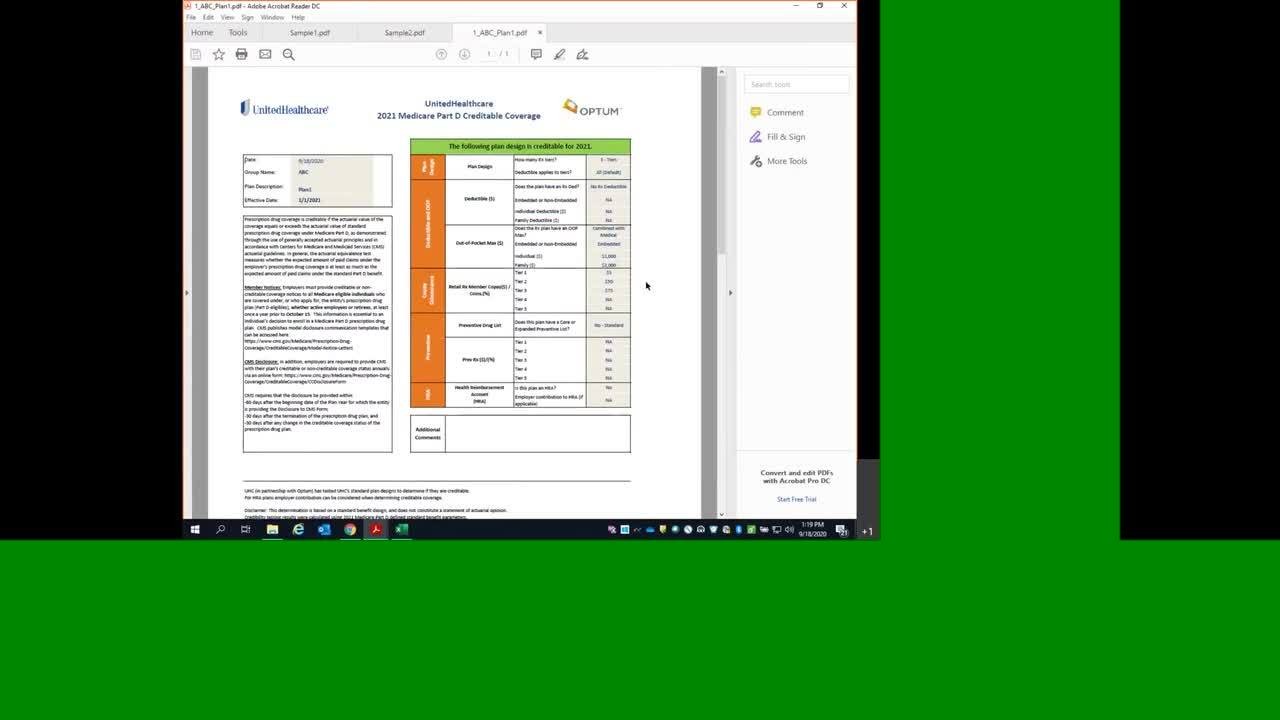

He navigates to the folder location and opens the first PDF.

MALE NARRATOR: So the first one is going to be the one that had a result of "pass." So here we can see, we have this template, which may look familiar because it's how the old lookup tools were formatted. So at the top you can see "the following plan design is creditable for 2021," and then it has all of the inputs, has the disclaimer, and has information about creditable coverage. So the date, group name, description effective date, and now the plan design features. That was the first one.

He opens another PDF.

MALE NARRATOR: And then back in the directory, we can see that for the custom test, the file is named "custom test," so you know what to send to the mailbox. So this one looks the same, and it just says "the following plan design requires a custom test." Then you can just attach however many you have to an email and send that to the creditable coverage mailbox to get a determination there. Okay, so now we're back in the workbook. So we're gonna do a few more examples. So you can just click the "clear all" input button, and it'll get rid of all of your inputs. And then we're gonna do two examples. So we're just gonna change the number of plans back to two.

He changes the number of plans from four to two, and two of the columns disappear. He opens a sample Benefit Summary.

MALE NARRATOR: So we get lots of different plan documents in the mailbox, so we're just gonna use this one as an example. So this is one--sometimes the medical and Rx summary will be combined in a single document, and other times, they'll be separate. So this is an example of a separate Rx document that just talks about the prescription drug cost sharing. So here you can see there's an annual drug deductible. And it's a--there's 250 for new individual, 500 for a family, and the deductible does not apply to tier one. Out of pocket drug limit, it says, "see the medical benefits summary for both individuals and families," so we know that that would be combined with medical. Then if we go down one page here. And these documents will also have the actual cost sharing for all the tiers. So we can see there's four tiers. And then we always do the retail in network, so it would be 15, 40, 80, 350. So now we can see how we would input that into the tool. Okay, so we--so now we're going to input the group name and the description and the effective date. And we do want a PDF. So we know that there's full four tiers. And deductible does not apply to tier one, so instead of "all default," we enter tier 2 plus. Rx only. It'll be "Rx only" in the deductible. 250 and 500. And then these four tiers. Out of pocket max first. So we're just gonna use a sample that we have. So 1,000 individual, 2,000 family. And then we can move on to the actual cost sharing. Okay, and then on this first design, if we scroll down, we can see we also input standard preventive lists and that there's no HRA. Now we're gonna move on to the second example. So we have another plan to document.

He opens a sample Plan Document.

MALE NARRATOR: So this plan document, unlike the other one that we were showing, this document has all the information about the prescription drugs and the medical plan. So the section we're paying attention to here is the one that says, "are there other deductibles for specific services?" So in the

Answers column, it says, "Yes. Prescription drugs: 1,000 individual, 3,000 family, does not apply to tier one drugs. So for now, we can tell that the deductible section would be Rx only, 1,000, 3,000, and then I believe there's four tiers here. And then we would say, "deductible applies to tier two plus, only." And then we can see the out of pocket limit is 8,150, 16,300. And then going down to the different tier cost sharing. So for network provider, we see the copay is 20, 65, 100, 200. And tier one, you see it says, "deductible does not apply. So just showing again that the deductible is for tiers two and above only. And then if you have one of these files and each one of the tiers says, "deductible does not apply," then you know that there would be no Rx deductible. Now we're going to input that into the tool, and we'll look at the results.

The form fills in, and he clicks Display Creditability Results. The results appear as new rows at the bottom.

MALE NARRATOR: So we have the new plan designs entered. So now we're gonna click the "display creditability results." Now down at the bottom, we can see the first one passes, so it is creditable for 2021. Second one will require a custom test. So looking in the panel on the left, you can see there is an email, creditable.coverage@optum.com. So if you need a custom test, determinations for prior years, or just any other questions about this process, you can reach out to that email, and they will get back to you with whatever you need. So during the creditable coverage season, we update the tools regularly, so that we'll have fewer custom tests, you know, using the custom tests that you all send us. So it's important to make sure that you are using the most up-to-date tool. So there's a version number in row 55 there that'll tell you which version you are using.

He hovers his cursor over a line that reads: “Version Number: 2021v1.0”

MALE NARRATOR: So it's important to make sure to use the most up-to-date tool. And so that is all we had for today so thank you all for tuning in, and good-bye.